Numismatic coins have significantly higher volatility than bullion coins and do not enjoy the same liquidity. Numismatic gold and silver coins are typically purchased by coin collectors and speculators. Bullion coins contain a 90% (as a minimum) to as much as 99.99% (considered pure) gold content. This cost that is added to the underlying spot price is referred to as “premium” and is the price at which these coins trade in the marketplace. Their price is determined by the spot price and a cost that is added to cover 1) the cost of production, 2) distribution and 3) retail sale. Gold investors usually buy gold and silver bullion coins because their prices are completely transparent and their liquidity is typically excellent. There are two basic types of gold and silver coins: Bullion Coins and Numismatic Coins Bullion Coins ( See our IRA Page.) Types of Gold and Silver Coins Many gold and silver coins and bars are eligible for inclusion in Precious Metals IRAs. Investing in gold and silver is an excellent way to provide diversification and precious metals have become a standard asset class for many investment portfolios. To help you make sense of the many investing options available, we have provided the following brief summary of Gold and Silver Coin and Bar facts.įisher Precious Metals offers a large inventory of gold and silver coins, bars and bullion at industry leading prices. United States, Canada, South Africa, Australia, etc.) as well as private mints and refiners who produce gold and silver coins, bars and bullion for the investing market.

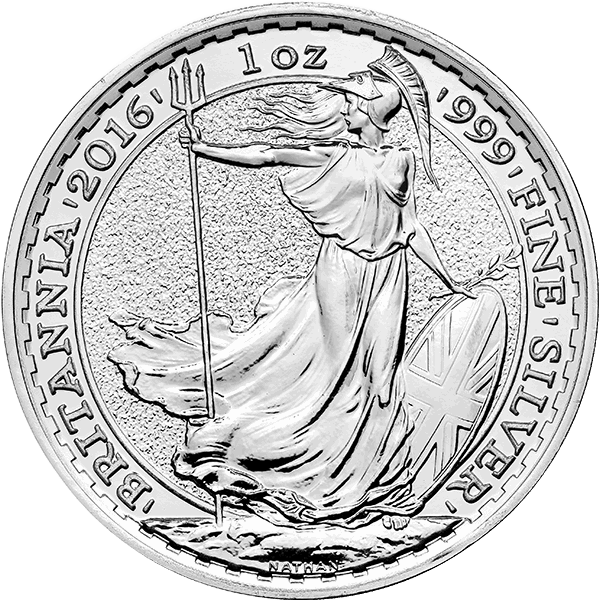

a_silver%2Bcoins%2Bsilver%2Bbritish%2Bcoins.jpg)

A number sovereign mints (national mints of countries. Gold and silver coins and bars come in a variety of weights and designs. Here you will find some basic Gold and Silver facts that every precious metals investor should know. A great investment alternative to bullion coins and bars!

Here you will find our 24kt bracelets that contain 1 troy oz of pure gold. 24k Jewelry – Portability and gold content are the key factors that investors consider when buying bullion jewelry.

We always recommend that our clients buy loose GIA diamonds and then work with us or even their local jeweler to have the stone set in the setting of their choice or a custom made setting. Loose Diamonds – Buy Loose GIA Diamonds Buying loose GIA diamonds the right way can save you a significant amount of money.Learn the basics of buying diamonds wisely. Diamond Education – Here we take the mystery out of buying diamonds and remove the intentional lack of information you often find in the typical retail jewelry market.Demand for Palladium has increased greatly in recent years ,and has become a more widely recognized investment amongst precious metals investors.

0 kommentar(er)

0 kommentar(er)